#What is better: optimistic or zero-knowledge rollups

Explore tagged Tumblr posts

Text

Optimistic Rollups vs ZK-Rollups: A Quick Guide

As blockchain technology continues to revolutionize industries, the need for scalable solutions becomes increasingly urgent. Ethereum, one of the leading blockchain networks, faces significant challenges in handling high transaction volumes efficiently. Enter rollups, a game-changing layer 2 scaling solution designed to alleviate these issues.

Rollups are an innovative approach to improving blockchain scalability by processing transactions off the main chain (Layer 1) and then submitting them in batches, thus reducing congestion and costs. There are two main types of rollups: Optimistic Rollups and ZK-Rollups (Zero-Knowledge Rollups). Optimistic Rollups assume transactions are valid by default and only use fraud proofs to handle disputes, offering lower gas fees and increased throughput. However, this method introduces a slight delay in transaction finality due to the need for challenge periods.

On the other hand, ZK-Rollups leverage zero-knowledge proofs to validate transactions, providing immediate finality and enhanced security. While this approach requires significant computational resources, it ensures that transactions are inherently valid and almost impossible to tamper with. The blog delves into a detailed comparison between these two rollup types, highlighting their unique advantages, drawbacks, and ideal use cases.

Intelisync, a leader in blockchain development services, has successfully implemented rollup solutions to address scalability challenges for various clients. By leveraging these advanced technologies, Intelisync helps businesses enhance their blockchain platforms' performance and user experience. Ready to scale your blockchain application? Contact Intelisync today to explore how we can support your journey towards Learn more....

#Blockchain Development Services#Comparing The Differences Between Optimistic and ZK-rollups#Ethereum Scaling Explained#Fraud and Error Handling#How do I get started with optimistic and zero-knowledge rollups?#Optimistic Rollups vs ZK-Rollups#What are Optimistic Rollups?#What is better: optimistic or zero-knowledge rollups?#What is the future of Optimistic and Zero-Knowledge Rollups?

0 notes

Text

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

New Post has been published on https://thedigitalinsider.com/layer-2-solutions-and-how-they-will-affect-ethereum-technology-org/

Layer 2 Solutions And How They Will Affect Ethereum - Technology Org

If you’re active in the crypto domain, you’ve probably noticed a fall in the popularity and usage of Ethereum. This has mostly come from the high fees that come with making transactions on the platform, moving users from once-popular areas to more favorable ones, such as BSC and SOL.

In an attempt to bring back the old glory of ETH, a thing called Layer 2 was created, and today, LI.FI is bringing you on a journey of the solutions that Layer 2 brings with it, creating new possibilities for Ethereum.

Ethereum cruptocurrency – artistic impression. Image credit: WorldSpectrum via Pixabay, free licence

What is Layer 2?

First, let’s get to know our main actor – Layer 2. We can simply describe it as being an add-on to lower blockchains, called Layer 1, with its role being a tool for better connectivity and interoperability between blockchains. Just as DeFi Saver helps you with managing your assets, Layer 2 helps the transaction of them, making the whole process faster and smoother.

We can imagine the whole of Ethereum as one big river, and its water, representing transactions, growing more and more, causing it to overload and leak. Layer 2 solutions, in this case, would represent chutes separating from the river and taking part of the leverage of water with them, making it easier for the river to flow smoothly, just as they make transactions in the crypto world.

Now that we’ve defined Layer 2, let’s see exactly how it helps Ethereum.

Types of Layer 2 solutions and how they impact Ethereum

There are several solutions that have been and are developing to help Ethereum.

The first one is a sidechain. As described above, they serve as side blockchains running parallel to Ethereum. Two of them are connected by a bridge. Sidechains have worse security systems and serve only as a roundabout way of transactions.

The next one would be rollups. Rollups are a scaling technique that executes transactions outside the main Ethereum chain (off-chain) but stores transaction data on-chain. The core idea is to “roll up” or bundle many transactions into a single one, thereby reducing the overall load on the network. Rollups can be divided into optimistic and zero-knowledge. The main difference between them is the way they do or do not decide whether the transaction is valid.

The third solution would be state channels. State channels involve two or more participants locking a portion of the blockchain’s state (e.g., a set amount of cryptocurrency) in a multi-sig contract. Transactions between these participants then occur off-chain, and only the final state is recorded on the blockchain. Transactions within a state channel are nearly instant, as they don’t require blockchain confirmation each time. State channels offer more privacy since intermediate transactions aren’t publicly recorded on the blockchain.

One limitation of state channels is that they are best suited for scenarios where participants are known and willing to engage in multiple transactions over time.

Conclusion – Layer 2 solutions run so that Ethereum can walk!

These solutions, together with many others, have over time helped Ethereum to start getting back on track by taking the role of the accelerator of the transaction processes. By covering different holes in the Ethereum operating system, these solutions make sure the platform keeps performing better and better. Thanks to them, the future of Ethereum promises a more scalable and sustainable environment for crypto lovers to roam around!

#add-on#assets#Blockchain#bridge#bundle#channel#connectivity#crypto#cryptocurrency#data#Difference Between#Environment#Ethereum#Fintech news#Future#how#it#network#One#operating system#Other posts#privacy#process#Security#Special post#sustainable#technology#time#tool#transaction

0 notes

Text

Annotated edition, Week in Ethereum News, Jan 19, 2020

This is the 6th of 6 annotated editions that I promised myself to do.

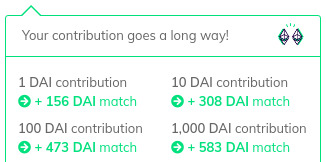

Like last week, it’s an opportunity to shill my Gitcoin grant page. Right now a 1 DAI (you can give ETH or any token) has an insane matching. Where else can you get a 150x return on a buck?

There’s about 24 hours left at the time this was published.

I shared on Twitter the graph of my subscriber count for the last 90 days:

The newsletter has gotten big enough to the point where the subscriber churn is enough to force negative days. It used to be that the day I sent the email, I’d get 90% of my new subs for the week from posting on Reddit. Now Reddit is saturated, and the number only goes up because of the long tail of word of mouth - which seems to be mostly seeded by the RTs of people who make the weekly most clicked as I post it to Twitter.

It’s clear that I’ve mostly bumped up against the ceiling of people who are willing to subscribe to a tech-heavy Eth newsletter. Perhaps there are other marketing channels, but seems unlikely to find people who want a newsletter, even if they are Eth devs.

This annotated version is an attempt to test whether writing for a larger audience would succeed. I think to some degree it has, but I also haven’t done a great job of contextualizing, nor adding narratives. Still working on it.

Eth1

Notes from the latest eth1 research call. How to get to binary tries.

Guillaume Ballet argues for WASM precompiles for better eth1 to prepare for eth2

StarkWare mainnet tests find that a much bigger block size does not affect uncle rate and argues that a further decrease in gas for transaction data would be warranted

Guide to running Geth/Parity node or eth2 Prysm/Lighthouse testnet on Raspberry Pi4

Nethermind v1.4.8

Eth1 is moving toward a stateless model like Eth2 will have. This will help make Eth1 easier to seamlessly port into eth2 when phase 1 is live.

In the meantime, people are figuring out what makes sense. Is it WASM precompiles? Will client devs agree to it?

StarkWare wants to reduce the gas cost again, which would make rollup even cheaper and provide more transaction scalability.

Eth2

The incentives for good behavior and whistleblowing in Eth2 staking

Danny Ryan’s quick Eth2 update – updated docs explaining the spec currently under audit

Options for eth1 to eth2 bridges and phase1 fee market

Simulation environment for eth2 economics

Ryuya Nakamura proposes the subjective finality gadget

Lighthouse client update – 40x speedup in fork choice, 4x database speedup, faster BLS

Prysmatic client update – testnet with mainnet config

A guide to staking on Prysmatic’s testnet

How to build the Nimbus client on Android

Evaluating Eth2 staking pool options

If you’re going to read one post this week in full, the “incentives for good behavior” is probably the one. This isn’t new info, but it’s nicely packaged up and with the spec under audit, this is very likely to be the final info. This answers many of the questions that people come to Reddit and ask.

Danny Ryan’s quick updates are also packed full of info.

the spec is out for audit. the documentation all got overhauled to explain the decisions -- ie, things needed for an audit -- with the expectation of a post-audit spec in early March. Obviously we hope for minimal changes and then set a plan for lunch.

There’s been lots of talk about how long we need to run testnets for, but i think it’s quite clear that anything more than a month or so of testnets is overkill. We’ve had various testnets for months, the testnets will get increasingly multi-client, including from genesis. Phase 0 is going to be in production but not doing anything in production - a bit like the original release of Frontier in July 2015.

We should push to launch soon. Problems can be hardforked away and the expectations should be very similar to the launch of Frontier.

Layer2

Plasma Group -> Optimism, raises round from Paradigm/ideo for optimistic rollups

Auctioning transaction ordering rights to re-align miner incentives

A writeup of Interstate Network’s optimistic rollup

Plasma Group changed their name to Optimism and raised a round. It’s hardly a secret that layer2 has been a frustration in Bitcoin/Ethereum for years, with no solution reaching critical mass, and sidechains simply trading off decentralization/trustlessness. Plasma Group decided to go for rollup instead of Plasma, due to the relative ease of doing fully EVM through optimistic rollup. Respect to Paradigm for having conviction and leading the round, as well as IDEO.

The auctioning of ordering rights is part of their solution.

Also cool is Interstate Network, who is building something similar. I’m unclear why they decided to launch with a writeup on Gitcoin grants, but it is worthy of supporting.

Stuff for developers

Truffle v5.1.9, now Istanbul compatible.

Truffle’s experimental console.log

New features in Embark v5

SolUI: generate IPFS UIs for your Solidity code. akin to oneclickdapp.com

BokkyPooBah’s Red-Black binary search tree library and DateTime library updated to Solidity v0.6

Overhauled OpenZeppelin docs

Exploring commit/reveal schemes

Using the MythX plugin with Remix

Training materials for Slither, Echidna, and Manticore from Trail of Bits

Soon you’ll need to pay for EthGasStation’s API

As of Feb 15, you’ll need a key for Etherscan’s API

Hard to miss the “time to get a key” for the API trend. But to be fair, it makes sense to require keys. It’s not surprising that providing it for free is not a business model.

Ecosystem

Gavin Andresen loves Tornado.Cash and published some thoughts on making a wallet on top of Tornado Cash

MarketingDAO is open for proposals

Almonit.eth.link launches, a search engine for ENS + IPFS dweb

Build token pop-up economies with the BurnerFactory

Tornado.cash is such a huge thing for our ecosystem that I feel no problem highlighting it forever. The complete lack of privacy isn’t 100% solved, but if you care about your privacy, Tornado Cash is super easy to use. I’ve said it before, but participating in Tornado is a public good -- you’re increasing the anonymity set.

The dweb using ENS and IPFS is interesting, worth watching to see how it evolves, though currently it only has 100 sites.

I hope to see more pop-up economies happen. It’s a great way to onboard people and give a better glimpse of the future than making people wait an hour for transactions to confirm.

Enterprise

EEA testnet launch running Whiteblock’s Genesis testing platform

Plugin APIs in Hyperledger Besu

Privacy and blockchains primer aimed at enterprise

A massive list of corporations building on Ethereum

Sacramento Kings using Treum supply chain tracking to authenticate player equipment

Neat to see the Kings experimenting with new tech, even if in small ways.

Meanwhile that list of building on Ethereum has 700+ RTs at the moment. Goes to the MarketingDAO above - there are many ETH holders who feel like Ethereum is undermarketed.

Governance and standards

EIP2464: eth/65 transaction annoucements and retrievals

ERC2462: interface standard for EVM networks

ERC2470: Singleton Factory

bZxDAO: proposed 3 branch structure to decentralize bZx

Application layer

Livepeer upgrades to Streamflow release – GPU miners can transcode video with negligible loss of hashpower so video transcoding gets cheaper

Molecule is live on mainnet with a bonding curve for a clinical trial for Psilocybin microdoses

Liquidators: the secret whales helping DeFi function. Good walkthrough of DeFi network keepers.

Curve: a uniswap-like exchange for stablecoins, currently USDC<>DAI

New Golem release has Concent on mainnet, new usage marketplace, and Task API on testnet

Gitcoin as social network

rTrees. Plant trees with your rDai

In typical Livepeer fashion, they didn’t hype up their release very much, but I think Streamflow could end up being very big. They think they can get the price point down for transcoders to being cheaper than centralized transcoders. How? Because GPU miners want to make more money and GPU miners can add a few transcoding streams with negligible loss of hashpower. This will become even more crucial when ETH moves to proof of stake, and miners will need to get more out of their hardware.

Lots of people loved rTrees. As a guy who has done all the CFA exams, I have had the time value of money drilled into me too much to ever think of anything as “no loss” but people love the concept.

Psychedelic microdosing and tech has become a thing. Tim Ferriss led fundraising a Johns Hopkins psychedelic research center, it will be interesting to see if Molecule becomes a hit in the tech community outside crypto.

Tokens/Business/Regulation

The case for a trillion dollar ETH market cap

Continuous Securities Offering handbook

The SEC does not like IEOs

Former CFTC Chair Giancarlo and Accenture to push for a blockchain USD

Tokenizing yourself (selling your time/service via token) was all the rage this week, kicked off by Peter Pan. Here’s a guide to tokenizing yourself

Avastars: generative digital art from NFTs

Speaking of the Eth community wanting more marketing, the trillion dollar market cap piece was the most clicked this week.

If you haven’t checked out Continuous Securities, it’s a neat idea.

The tokenizing yourself trend is easy to laugh at or dismiss, but they’re some small experiments that are worth watching.

General

Chris Dixon: Inside-out vs outside-in tech adoption

baby snark: Andrew Miller’s tutorial on implementation and soundness proof of a simple SNARK

Blake3 hash function

Justin Drake explains polynomial commitments

New bounty (3000 USD) for improving cryptanalysis on the Legendre PR

Mona El Isa’s a day in the life for asset management in 2030. We need more web3 science fiction

SciFi and zero knowledge (”moon math” as it occasionally gets called) section.

SciFi shows us the future, and zero knowledge solutions increasingly aren’t just the future, but also the present.

Full Week in Ethereum News post

0 notes

Text

How do cryptographic certification systems such as for instance ZK Rollup improve DeFi expansion, privacy and fairness?

Extension schemes such as for instance ZK Rollup have introduced two different types of entities: a little group of powerful participants invest plenty of resources to do intensive calculations; and a large group of weak nodes are responsible for verifying transactions and ensuring that the calculation results are auditable. Original title: "Introduction | Can stylish cryptography tools help DeFi?

The Decentralized Finance (DeFi) movement vowed to equalize the financial world and allow it to be more fair and transparent. However , if DeFi is always to accomplish this goal on a worldwide scale, a decentralized blockchain like Ethereum must expand its throughput! Which means that we need to use new cryptographic proof schemes (some people will reference these schemes collectively as "zero-knowledge proof" or "ZKP").

A cryptographic proof system like zk-STARK (which will undoubtedly be deployed on the Ethereum mainnet) is not the sole solution. Other methods include Plasma, Ethereum 2. 0, many so-called "Ethereum killers" proposals, and the most recent Optimistic Rollup proposal. In this essay, we shall explain the current challenges faced by decentralized cryptocurrencies, the paths of varied cryptographic proof systems to solve these issues, and why zk-STARK is the most suitable for solving this issue. The era of decentralization and expansion of processing capacity is an era where computer system throughput continues to improve. From bandwidth, to storage space, to the amount of pixels on a screen, every thing is continually improving. So , just why is it so hard to improve the transaction processing speed of Bitcoin and Ethereum (measured by TPS "transaction per second")? The solution is that people also want to ensure decentralization. The necessity for the blockchain to stay permission-free is that each and every user who uses an ordinary notebook can verify the integrity of the transaction history. There is a core principle here, which we call "acceptable accountability", meaning: we cannot rush to improve the processing capacity of the machine, otherwise it will degenerate in to a centralized payment system with just a few chaebols. The type of get a handle on (that is, the "current financial system"). We must break the blockchain trilemma and produce a decentralized financial system that is distinctive from conventional systems For that reason all extension schemes, including Plasma, Optimistic Rollup, and our method (based on a cryptographic proof system, frequently known as the ZK Rollup scheme), introduce two different types of entities: a little group of "strong" participants, Need to invest plenty of resources to do intensive calculations; there's also a large group of nodes, which are responsible for verifying transactions and ensuring that the calculation results generated by powerful participants are auditable. How do we scale throughput while ensuring decentralization? Then allow powerful participants calculate, and the weak participation guarantees to ensure auditability. Whether the strong participants are malicious is not important, the main thing is that the weak participants can guarantee accountability! Before diving in to the details, let's take a look at the cryptographic proof system. You have to know a little bit in regards to the cryptographic proof system. The cryptographic proof system was founded in 1980; its great value to the access-free blockchain has led to the emergence of the Cambrian of new theoretical constructions and new protocols in the blockchain field recently Big explosion. In these, we shall only concentrate on STARK, which is also a kind of proof solution that our StarkWare team is getting ready to bring to the market. Cryptographic certification systems frequently include two kinds of roles: the prover and the verifier.

* Prove: The prover wants to convince the verifier a certain computational statement is correct, such as for instance "I have processed these 10, 000 transactions, and the hash value of the resulting database is X". The verifier will provide an item of evidence with this computational statement and send it to the verifier. * Verifier: The verifier will verify the evidence-instead of naively repeating the first calculation process-if the data may be verified, the verifier will think that the prover's statement holds true. note! In a cryptographic proof system like STARK, the computational burden of the prover and verifier is asymmetric! When compared with simply performing the first calculation process, the calculation overhead of the prover is significantly larger; whilst the verifier is on the contrary, as a result of the huge overhead that the verifier has paid, the quantity of calculation that the verifier has to perform is smaller than the original calculation process A whole lot more. For instance , if 10, 000 transactions were originally required to be executed, the verifier only must pay the computational overhead of 10 transactions. Additionally , the cryptographic proof system enables you to conceal input (in the aforementioned example, the facts of the 10, 000 transactions may be concealed); this kind of cryptographic proof system is named "zero-knowledge", the abbreviation is ZK- STARK. How does the cryptographic certification system extend DeFi? So , in what ways can today's cryptographic certification systems help DeFi?

* Scalability * Privacy * Fairness, we shall come one at a time. Improve scalability with STARK Let us go back to the absolute most fundamental challenge: to steadfastly keep up inclusive accountability while expanding the throughput of Ethereum. We truly need a technology that will greatly increase throughput (by allocating the computational burden to a small number of "strong participants"), even though many "weak participants" can fully verify the computational integrity of these powerful participants. ), and it'll maybe not boost the burden on weak and small participants. Other extensions, such as for instance Plasma and Optimistic Rollup, depend on Fraud Proof, and we explained in this article why the cryptographic proof system is just a better solution (Editor's note: start to see the hyperlink at the conclusion of the text for the Chinese translation "Proof of Validity vs . Proof of Error"). Utilising the scalability of STARK (the speed of verification is an exponential of the speed of constructing a proof), we could bravely let any powerful entity become a prover, even Darth Vader & Sons (Darth Vader & Sons, the big one in Star Wars) The puppets controlled by the villain are fine. The main element here's a strong prover should attach a concise proof to any or all his operations, and all weak nodes can simply verify these proofs. For that reason through STARK (and other cryptographic proof systems), we could guarantee inclusive accountability, while providing almost unlimited throughput expansion (strictly speaking, we "can only" achieve exponential expansion).

In greater detail, the basis of ZK Rollup's scalability solution is always to allow large computing tasks (or a large number of small computing tasks) to be executed off-chain, and the off-chain computing resources are a lot more abundant; then the calculation execution process is generated The proof validity is delivered to the blockchain (accompanied by way of a promise of the new state); then a validator smart contract verifies these proofs. After verification, network participants can think that the complete calculation is valid (and at the same time do not need to trust any entity). It really is properly because we do not have any trust assumptions that people can fairly accept a valid evidence, even when it's issued by the Black Warrior. This isn't just talking-you will be able to put it to use on the mainnet in a few days! These are maybe not items that remain on paper: using StarkEx, our scalability engine, we have achieved a throughput greater than 9, 000 self-hosted transactions per second (a 2000 times increase compared to the Ethereum main network) )! Moreover, this isn't the limit: we are maybe not limited by blockchain resources, only by cloud resources. The end-to-end trading services and products will undoubtedly be launched on the mainnet soon. The initial DeversiFi decentralized exchange supported by the StarkEx engine will undoubtedly be launched in a few days. And an NFT exchange supported by StarkEx can be under intense development, that'll support the trading of in-game assets.

Enhancing privacy and improving transaction processing speed by ZKP is not an adequate condition for public chains to become popular. We also need privacy. The pioneers of people chain discovered the benefits of ZKP for privacy before they discovered the benefits of ZKP for scalability. The Zcash blockchain, launched in 2016, may be the first system that uses the ZKP scheme to supply covert transactions. Privacy can be critical to achieving an efficient market. When traders trade available in the market, they both want to be free and not to expose their unique information. Access-free blocks (and DeFi) are completely transparent in design: in order for all small nodes to verify hawaii of the blockchain without introducing any trust assumptions, all transactions will undoubtedly be made public on the chain. For that reason the process is: how exactly to obtain privacy without sacrificing the trust-free nature of DeFi? You are able to take advantage of ZKP's zero-knowledge attributes! As stated above, zero-knowledge proof we can prove a computational statement without making private input public. When this attribute is applied to the blockchain, unique information may be included in the private input, and the data won't expose this input at all. The result is that most people are happy: privacy may be protected, and at the same time anybody can verify hawaii of the blockchain without introducing trust assumptions, perfect. This isn't even bragging, you can already put it to use! A few teams have previously used ZKP on Ethereum to create privacy enhancement solutions, including Tornado. cash and AZTEC. Tornado uses the coin mixer method, while AZTEC uses the transaction pool method (which is more effective? ). We are expectant of other available choices to emerge.

Note: Privacy does not mean anti-regulation. The requirement for privacy of market participants can coexist with the necessity for regulators to see or watch and monitor the healthiness of the market. For example: a company can create a zero-knowledge proof tax payment, in place of sharing all its books with tax collectors. The privacy of organizations is protected, and regulators can trust that taxes have already been collected (examples of this is seen here). ZKP's enhancement of fairness in a reasonable market is not just meaningful in philosophy. Traders will always be far from trading venues they think are unfair. For that reason fairness is helpful to liquidity. There are many approaches to harm the fairness of the market, but most of them involve the abuse of the best of advance knowledge by system operators (such since the exchange itself). ZKP might help participants make certain that operators cannot abuse their own privileges and cannot be partial. A prominent example may be the front-running transaction. Preemptive trading implies that market makers use advance information to trade before the others know the data, which is illegal. About the impact of runaway transactions available on the market, everybody's estimates will vary, however the accepted conclusion is that the impact is huge and it is maybe not conducive to advertise efficiency. ZKP can solve the issue of preemptive transactions, because the privacy protection of traders can not only prevent other traders, even operators can not see through-this means that operators cannot profit from informed privileges and invite operators to come back to their The original location. Develop to see this kind of solution. There is still plenty of work to do! You want to allow it to be easier for developers to have these technologies, but additionally to improve the efficiency of these technologies. Moreover, you want to develop the Layer-2 solution, and we also have to think of how exactly to maybe not break the strong composability of DeFi. Gleam lot of work to be performed (if you wish to have an intuitive understanding of the perfect solution is, you can look at the principle of conditional payment. And how StarkEx enables you to achieve fast withdrawals). The scalability and privacy of the cryptographic certification system can transform DeFi from the sandbox of financial innovation to a worldwide force that will change the prevailing financial system. Cryptographic certification systems, such as for instance ZK-STARK, not only have advantages over other solutions when it comes to scalability, but additionally support better market design and create better markets with privacy and fairness.

#earn free crypto#bitcoin cloud mining free#earn free bitcoins instantly#earn cryptocurrency#get free bitcoin

1 note

·

View note

Text

Narrative edition, Week in Ethereum News, Jan 12, 2020

This is the 5th edition of the 6 annotated versions that I committed in my head to doing when I decided to see how an annotated edition would be received.

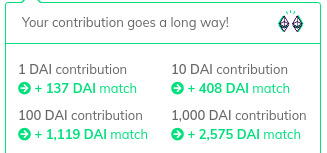

Given the response on my Gitcoin matching grant, I may have to keep going. Check it out - giving 1 DAI right now will get more than 100x matching.

Thanks to everyone who has given on my Gitcoin grant. It’s the best way to show you want these annotated editions to continue.

Even 1 Dai is super appreciated given the matching! Since Tumblr adds odd forwarders to links, here’s the text of the link: https://gitcoin.co/grants/237/week-in-ethereum-news

Eth1

Latest core devs call. Notes from Tim Beiko, discussion of EIPs 2456, 1962, 2348

EthereumJS v4.13 – bugfix release for Muir Glacier

Slockit released a stable version of their Incubed stateless ultralight client, aimed at IoT devices. 150kb to verify transactions or 500kb including EVM. incentive layer coming soon.

A little slow on in the eth1 section, but Incubed getting to be stable is cool. Obviously if they can get the incentive layer worked out, that will be fantastic.

When I think about that that I was wrong about, definitely if I go back to q1 or q2 2017, I thought that IoT Ethereum was much more of a thing. There was Brody’s early washing machine prototype, Airlock->Oaken, Slockit had some stuff 3 years ago, etc. It hasn’t really happened.

Why not? It seems to me like most of those things require enterprises to take the plunge. No one is going to go out and manufacture a domestic electronic device just yet with all the uncertainty there.

And light client server incentivization hasn’t happened yet. There’s just things to be built still. So it’s cool to see Incubed hitting a stable release. Slowly but surely all the necessary primitives get built. I still think there will be lots of robots transacting some day.

Eth2

Latest Eth2 implementer call. Notes from Mamy and from Ben.

Latest what’s new in Eth2

Spec version v0.10 with BLS standards

Prysmatic restarted its testnet with a newer version of the spec and mainnet config

Lodestar update on light clients and dev tooling

3 options for state providers

Eth2 for Dummies

Exploring validator costs

Eth2 for dummies was the most clicked this week. Even within the universe of people who subscribe to the newsletter, there’s always demand for high level explainers.

The spec is essentially finalized and out the door for auditing, so now it’s a sprint towards shipping, though of course there may be some minor changes as a result of further networking and of course from the audit.

Lately some in the community have been promoting a July ship date and I personally would be disappointed if it slipped that far.

Layer2

Optimistic rollup for tokens Fuel ships first public testnet

Optimistic Game Semantics for a generalized layer2 client

Loopring presents full results of their zk rollup testing

StarkEx says they can do 9000 trades per second at 75 gas per trade with offchain data, with the limiting factor being the prover, not onchain throughput.

9000 is a pretty crazy number, although since the data is offchain that makes it a Plasma construct and not a rollup. StarkWare to my memory hasn’t provided details on what the exit game is - as an end user do i get a proof I can submit if i need to exit? I have no idea.

Anyway, it’s very cool that the limiting factor is the prover, ie, nothing about Ethereum is what is currently limiting the 9000 transactions per second number.

Of course Loopring would also have a fairly crazy number if they did offchain data, but they have a thousand or 2k tps per second number with onchain data, and let’s be honest: right now the limiting factor here is the demand for dexes. No dex at the moment can fill even a hundred transactions per second. But as trades get cheaper, presumably there is more demand. And token trading will certainly increase in the next bull market.

Meanwhile Fuel shipped its first testnet. Very neat.

Stuff for developers

An update on the Vyper compiler: there’s now two efforts, a new one in Rust using YUL to target both EVM & ewasm as well as the existing one in Python.

A look at vulnerabilities of deployed code over time

a beginner’s guide to the K framework

Vulnerability: hash collisions with multiple variable length arguments

Verifying wasm transactions (and part2)

Austin Griffith’s eth.build metatransactions

Build your own customized Burner Wallet

Abridged v2 aiming to make it easy to onboard new users of web2 networks

Ethcode v0.9 VSCode extension

Embark v5

The Vyper saga is interesting. The existing Vyper compiler had a number of security holes found. EF’s Python team decided they didn’t like the existing codebase. So now some of the existing Vyper team is continuing on with the existing Python compiler, whereas there will also be an effort to write a Vyper compiler in Rust but to the intermediate language Yul, which means it will have both ewasm and EVM.

Also interesting to see the data viz of depoyed vulnerabilities over time. App security has been improving!

Ecosystem

RicMoo: SQRLing mnemonic phrases

ethsear.ch – Ethereum specific search engine

Avado’s RYO node – nodes opt-in and let users access them via load balancer

30 days of Eth ecosystem shipping

Aztec’s BN-254 trusted setup ceremony post-mortem. Confidential transactions launching this month

RicMoo always has interesting posts on techniques to use in Ethereum that aren’t mainstream. This one is pretty interesting.

I’m very excited about Aztec’s confidential transactions shipping this month. Much like Tornado, this is huge. The difference is that Aztec is about obscuring transaction amounts. Well, it’s about more than that and will be an interesting primitive for people to build with.

Enterprise

700m USD volume on Komgo commodity trade finance platform

TraSeable seafood tracker article on the challenges points out the troubles with no private chain interoperability

Caterpillar business process management system

Q&A with Marley Gray about the EEA’s Token Taxonomy Initiative

700m USD. It continues to strike me that enterprise is one of Ethereum’s biggest moats, and yet I don’t think I do a great job covering it. Much of what gets published is press release rewrites.

And of course I did a small bit of editorializing by noting that an article on private chains was finding how hard it was to have all these private chains. They need mainnet!

Governance and standards

EIP1559 implementation discussion

EIP2456: Time based upgrades

Metamask’s bounty for a generalized metatransaction standard

1559 is important because it kills economic abstraction forever! It’s happening in eth2, it’d be nice to have it happen in eth1. While I think some of the tradeoffs have not been written about - and that originally caused me to be a bit skeptical, perhaps i’ll write a post about that -- it’d be great to get 1559 into production.

In general, Eth needs better standardization around wallets for frontend devs.

Application layer

Flashloans within one transaction using Aave Protocol are live on mainnet

Orchid’s decentralized VPN launches

Data viz on dexes in 2019

ZRXPortal for ZRX holders to delegate their tokens to stakers

Dai Stability Fee and Dai Savings Rate go up to 6%, while Sai Stability Fee at 5%

EthHub’s new Ethereum user guides

It’s great that EthHub is doing user guides, that’s something that is missing. What’s also missing is a concerted Ethereum effort to link to stuff so that old uncle Google does a better job of returning search results.

Aave’s flashloans is another neat primitive. Things unique to DeFi.

Tokens/Business/Regulation

David Hoffman: the money game landscape

Australia experimenting with a digital Aussie dollar, with a prototype on a private Ethereum chain

3 cryptocurrency regulation themes for 2020

OpenSea’s compendium of NFT knowledge

A newsletter to keep track of the NFT space

Initial Sardine Coin Offering

NBA guard Spencer Dinwiddie’s tokenized contract launches January 13

Progressive decentralization: a dapp business plan

I wrote a Twitter thread about Dinwiddie’s tokens. I’m curious how they do, given that the NBA made him change plans and just do a bond. I haven’t seen the prospectus, and press accounts have conflicting information, but it appears that the annual interest rate is 14%. In that case, I wonder who puts fiat in? I doubt anyone would sell their ETH at these prices for a 14% USD return. There is some risk, but it basically requires Dinwiddie to lose the plot and get arrested or fail a drug test. So it seems like quite a good return given the low risk (assuming it is indeed 14%)

That Sardine token is wild, but not crazy. I won’t even try to summarize it, but perhaps even weirder is that they announced it at CES. Is your average CES attendee going to have any idea what ETH is during the depths of cryptowinter? Unclear to me.

Lots of good stuff in this section this week. Jesse Walden wrote up the “get product market fit, then community, then decentralize” which has worked for a bunch of DeFi protocols.

It’s also the opposite of what folks like Augur and Melon have done. So far the “decentralize later” camp has gotten more traction, but I personally don’t consider this argument decided at all, especially if you are in heavily regulated industries like Augur or Melon where regulators might put you into bankruptcy just because they got up on the wrong side of the bed that morning.

I also think Augur could be a sleeper hit for 2020, and I think Melon’s best days are still in front of it.

General

Andrew Keys: 20 blockchain predictions for 2020

Haseeb Qureshi’s intro to cryptocurrency class for programmers

Ben Edgington’s BLS12-381 for the rest of us

Visualizing efficient Merkle trees for zero knowledge proofs

Eli Ben-Sasson’s catalog of the Cambrian zero knowledge explosion

Bounty for breaking RSA assumptions

It’s amusing how heavy crypto stuff often gets put into this section. The cryptography stuff is all super interesting, but not sure I can provide much more context for it.

Juxtaposed with intense cryptography in this section is Andrew Keys’ annual new year predictions. Always a fun read.

Haseeb’s class looked great. A place to pick up all the knowledge that has taken some of us years to piece together, blog post by blog post.

Full Week in Ethereum News issue.

0 notes